All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the cash money worth of an IUL are commonly tax-free as much as the amount of costs paid. Any type of withdrawals above this quantity might undergo taxes depending upon plan framework. Typical 401(k) contributions are made with pre-tax bucks, reducing taxed income in the year of the contribution. Roth 401(k) contributions (a plan attribute readily available in most 401(k) strategies) are made with after-tax contributions and afterwards can be accessed (revenues and all) tax-free in retired life.

Withdrawals from a Roth 401(k) are tax-free if the account has actually been open for at the very least 5 years and the person mores than 59. Properties withdrawn from a conventional or Roth 401(k) prior to age 59 might sustain a 10% fine. Not precisely The insurance claims that IULs can be your very own bank are an oversimplification and can be deceiving for lots of reasons.

You may be subject to updating associated health questions that can impact your continuous prices. With a 401(k), the cash is constantly yours, including vested company matching despite whether you stop adding. Danger and Warranties: Firstly, IUL policies, and the money value, are not FDIC insured like conventional savings account.

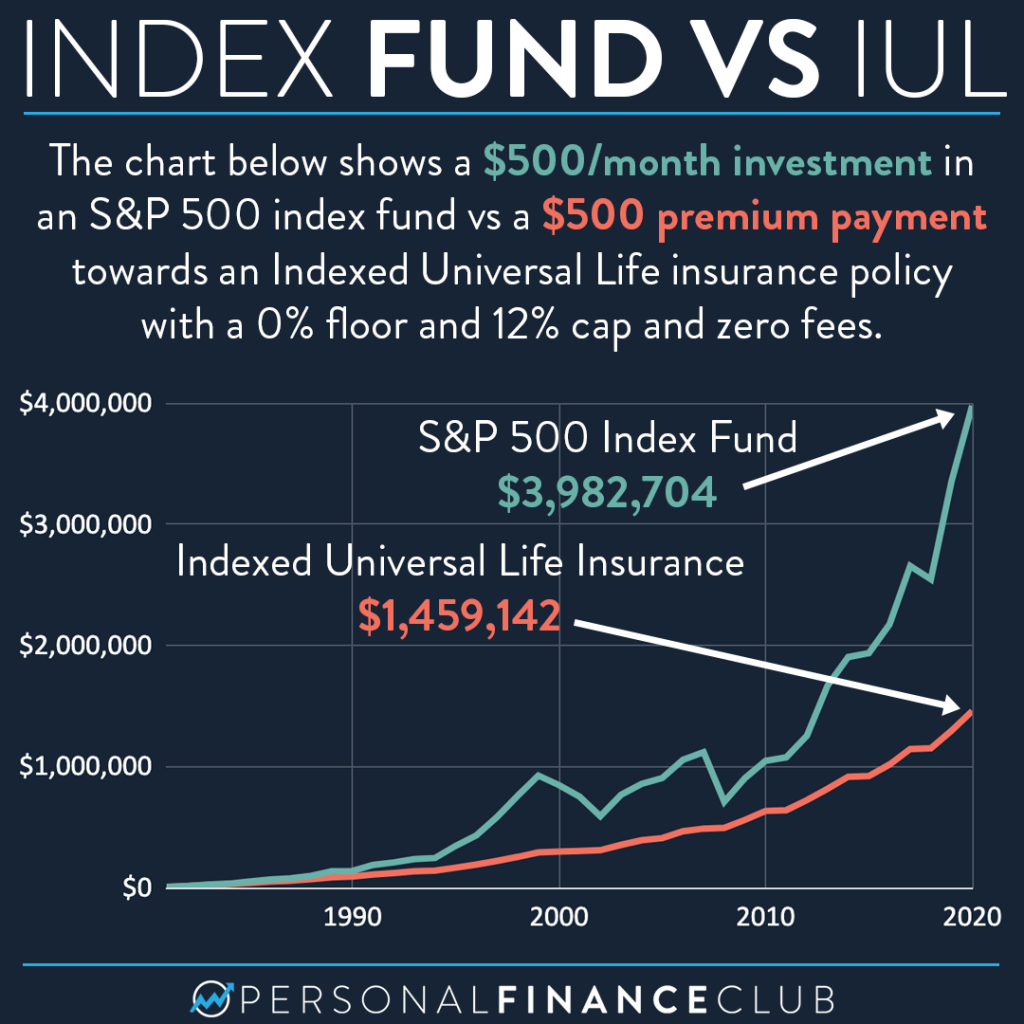

While there is usually a floor to stop losses, the growth potential is capped (implying you might not completely gain from market growths). The majority of professionals will agree that these are not similar products. If you want survivor benefit for your survivor and are concerned your retired life financial savings will certainly not be enough, then you may wish to take into consideration an IUL or other life insurance policy item.

Certain, the IUL can offer access to a cash money account, but again this is not the primary function of the product. Whether you desire or require an IUL is a highly specific inquiry and depends on your key financial goal and objectives. Listed below we will certainly attempt to cover benefits and constraints for an IUL and a 401(k), so you can further define these products and make a more enlightened choice concerning the finest way to manage retired life and taking treatment of your enjoyed ones after death.

Index Universal Life Insurance Canada

Car Loan Costs: Loans against the plan build up interest and, otherwise repaid, reduce the death advantage that is paid to the beneficiary. Market Involvement Limits: For most plans, financial investment growth is linked to a supply market index, however gains are commonly covered, limiting upside potential - h iule. Sales Practices: These policies are frequently marketed by insurance policy agents that might emphasize advantages without totally explaining expenses and threats

While some social media pundits recommend an IUL is a replacement product for a 401(k), it is not. Indexed Universal Life (IUL) is a kind of long-term life insurance policy that likewise uses a money worth part.

Latest Posts

Iul Insurance Explained

Indexed Universal Life Insurance Quotes

Nationwide Iul Accumulator Review